santa clara county property tax calculator

Please take a short survey to let us know how we are doing. Notices such as these are not authorized nor sent by the County of Santa Clara Department of Tax and Collections.

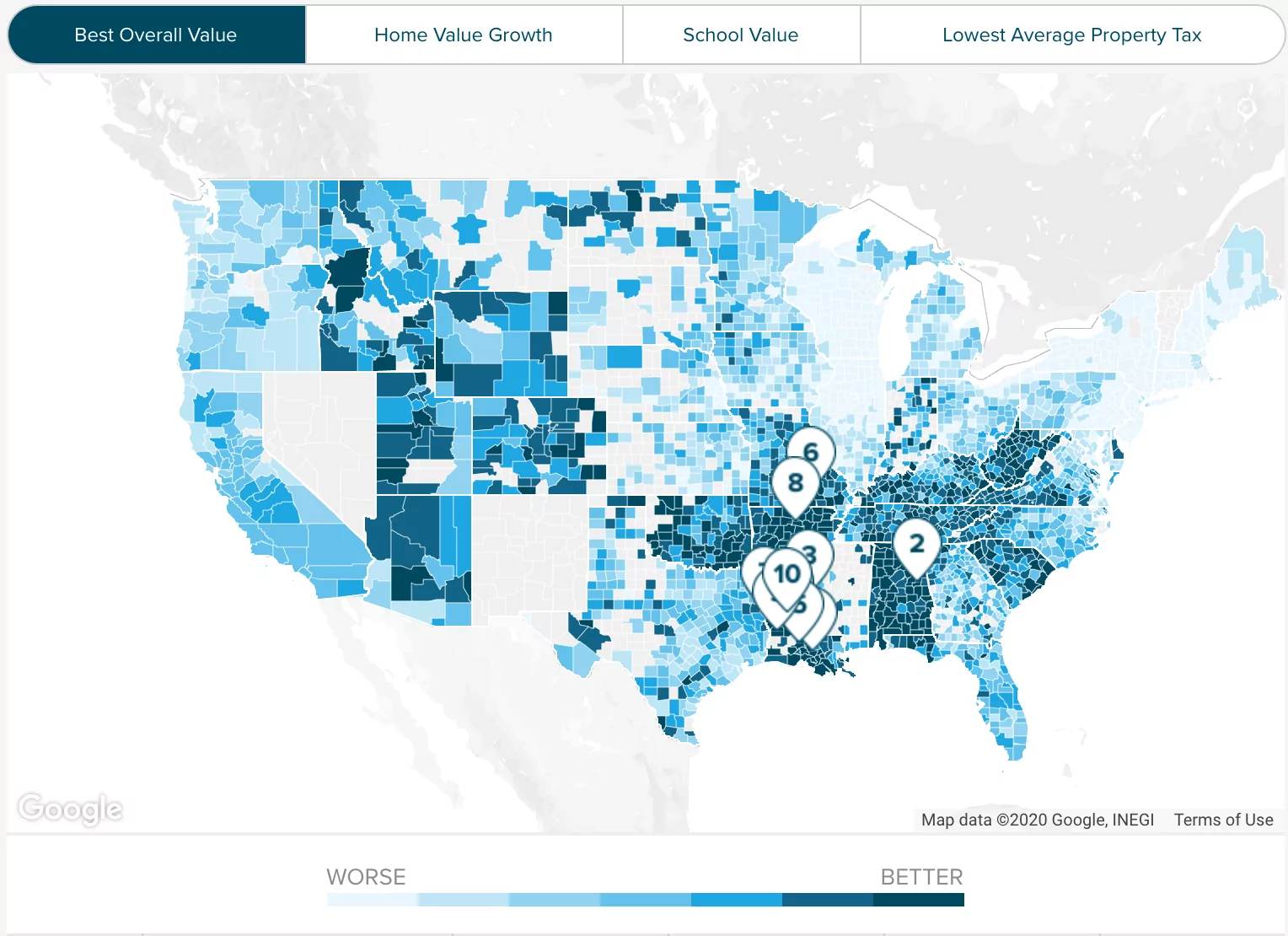

Property Tax By County Property Tax Calculator Rethority

Estimate the cost of converting part of your home or constructing a rental unit.

. San Jose California 95110. Home - Department of Tax and Collections - County of Santa Clara. County of Santa Clara.

Narrows the Assessed Value that can be transferred to two kinds of inherited property. Fill out the tax credit calculator. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

The median property tax on a 70100000 house is 469670 in Santa Clara County. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Enter the Property Sale Price - 10000 Minimum Value no comma seperators Step 2.

Property used continuously by the child or grandchild as a primary home or property held as a family farm. Santa Clara County Ca Property Tax Calculator Smartasset. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

The Controller-Treasurers Property Tax Division allocates and distributes the. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the. If you are qualified to port any of your deferred value then your actual taxes will be lower than this estimate.

The median home value in Santa Clara County is among the highest in the nation at 913000. Property tax is generally calculated as the value of the ADU times the jurisdictions tax rate. Your base Prop 13 assessment will not change.

Ad Find Out the Market Value of Any Property and Past Sale Prices. The median property tax on a 70100000 house is 518740 in California. Santa Clara County collects very high property taxes and is among the top 25 of.

Starting February 16 2021 Proposition 19 narrows substantially the property tax benefits for inherited properties. Santa Clara County California. A tax bill is issued only on the added value and is.

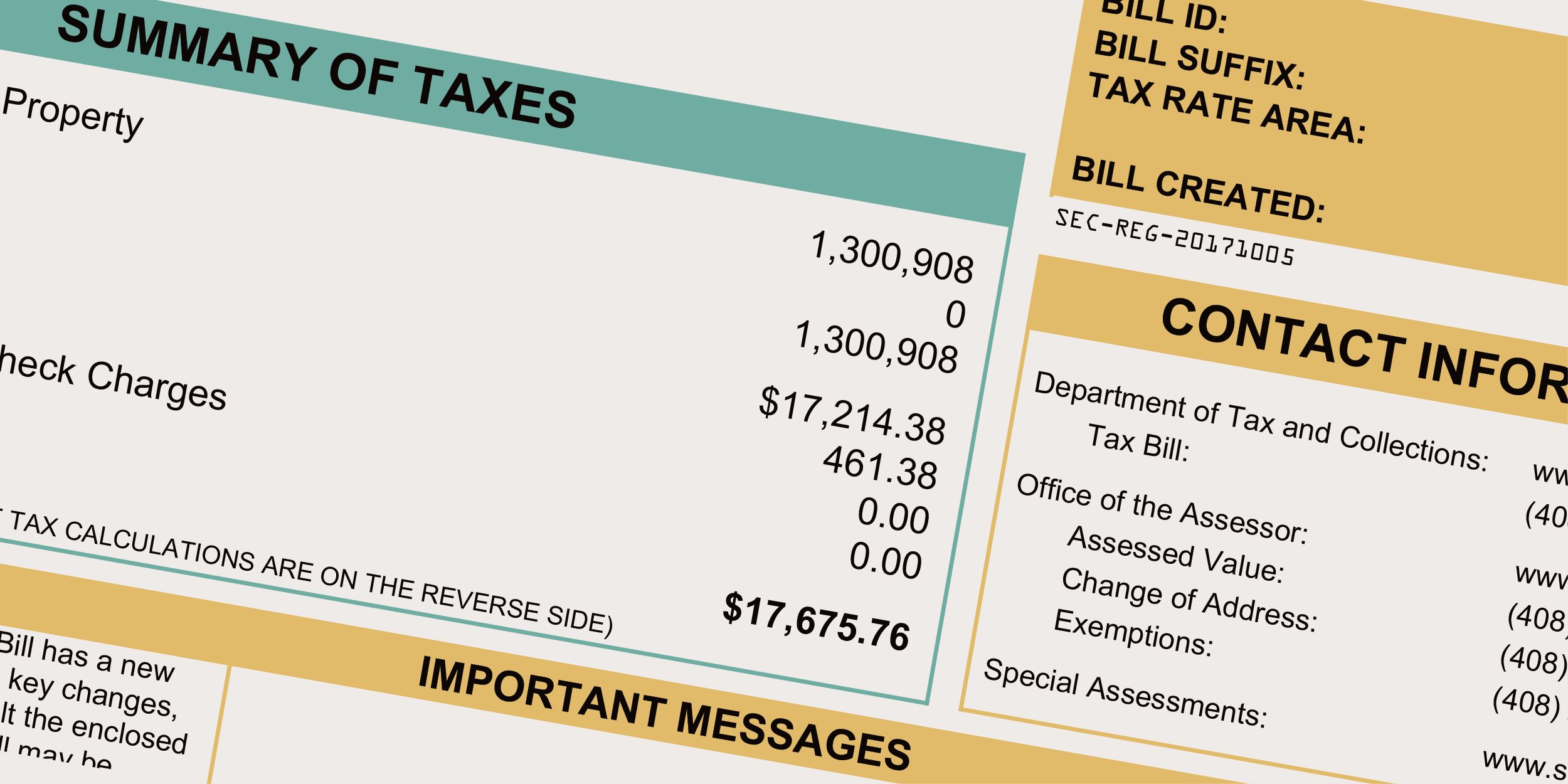

Property Taxes Department Of Tax And Collections County Of Santa Clara. Property used continuously by the child or grandchild as a primary home or property held as a family farm. Three groupsCounty Assessor Controller-Treasurer and Tax Collectoradminister the Countys property taxes.

Accessory Dwelling Unit Calculator. Your feedback is important to us. Select a taxing district from the drop down list and the corresponding millage rate will be entered.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. The Property Tax online viewpay system will be unavailable from 600PM - 1100PM on June 22 2022 due to maintenance. The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate of 067 of property value.

Santa Clara County California. The median property tax on a 70100000 house is 469670 in Santa Clara County. If you have any questions please call 408-808-7900.

Because of these high home values annual property tax bills for homeowners in Santa Clara County are quite high despite rates actually being near the state average. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. They are in addition supplemental to the traditional annual assessment and property tax bill. Santa Clara County Assessor Santa Clara County Assessor.

If you have any questions please call 408-808-7900. Tax Rate Book Archive. Learn all about Santa Clara County real estate tax.

70 West Hedding Street East Wing. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current.

SaveLoad My Settings. The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information. The median property tax on a 70100000 house is 736050 in the United States.

Supplemental assessments are designed to identify changes in assessed value either increases or decreases that occur during the fiscal year such as changes in ownership and new construction. Property Tax Rate Book. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Please be advised any notices sent by the Department of Tax and Collections will have the County Seal and the Department of Tax and Collections contact information. The median annual property tax payment in Santa Clara County is. Santa Clara County Property Value Increases In 2021 San Jose Spotlight.

Paying Your Property Tax The Santa Clara County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your.

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Understanding California S Property Taxes

Property Tax By County Property Tax Calculator Rethority

What You Should Know About Santa Clara County Transfer Tax

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Santa Clara County Ca Property Tax Search And Records Propertyshark

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

Property Tax By County Property Tax Calculator Rethority

Santa Clara County Ca Property Tax Calculator Smartasset